How to register TIN Number in Ghana and things you can’t do without TIN

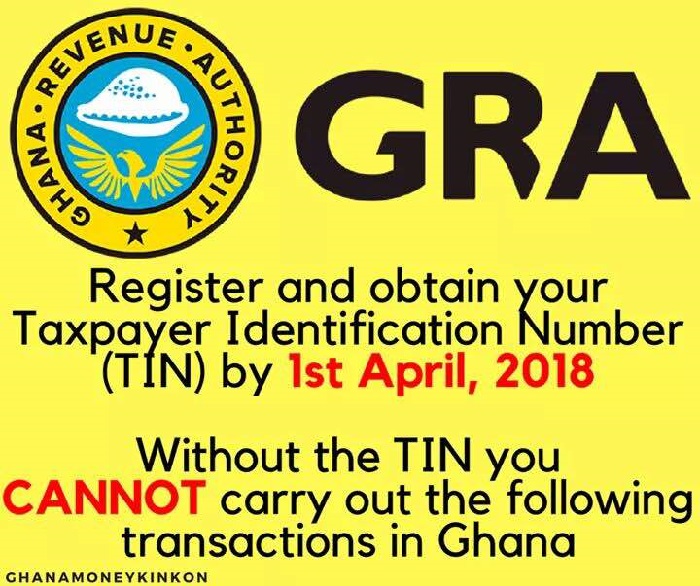

Beginning April 1, 2018, persons not registered with the GRA to be issued with a Tax Identification Number (TIN) will find it impossible to conduct official business and access some basic public services in the country.

The Commissioner General of the Ghana Revenue Authority, Emmanuel Kofi Nti, Tuesday told journalists at a press briefing that persons without a TIN will be unable to open a bank account, file a case in court, acquire a passport or obtain a driver’s licence.

Mr Nti added that persons without TIN numbers will also be unable to register a vehicle, clear goods in commercial quantities from the ports or register any title to land or any document affecting land.

“[The] policy is not a new tax for citizens even though it is to enhance revenue generation by ensuring that all potential taxpayers are captured,” Mr Nti stressed.

Register for the Ghana Taxpayer Identification Number (TIN) here

Without new Tax Identification Numbers (TINs) No licences, passports and clearance of goods at ports from January 2017

“I wish to reiterate that registration for TIN comes at no cost to the taxpayer, it is absolutely free…we appeal to the public to take note that this is a free service and to report any staff of GRA who violates this principle. Such erring staff will be severely sanctioned,” he added.

The GRA had earlier indicated that the enforcement of the TIN policy was to begin on April 1.

A TIN is a unique 11-digit number generated by the GRA for persons including corporate entities upon application. It is part of efforts to improve tax compliance and broaden the tax net.

It is free to obtain the number and the GRA encourages the reporting of persons who demand payment to process the TIN.

The GRA as part of its operational standards pledges to generate the number within 48 hours upon application accompanied with a valid national identification number such as driver’s licence, passport, voter’s ID.

How to Register TIN in Ghana

Offline Registration of TIN in Ghana

When registering for Taxpayer Identification Number in Ghana, the documents used are the ones below.

Tax type forms

- Individual or Sole-proprietors tax registration Form and

- Business or Organization tax registration form

- Advertisement -

TIN registration in Ghana involves the following three steps

- Obtain the Ghana Revenue forms form any of the GRA offices across the country

- Fill the form

- Submit the duly filled form and present a valid document for identification

Once the application for Tax Identification Number is made, the applicant will wait for not more than 14 days. The TIN can after that is collected from the designated office.

That said, who then can register for Taxpayer Identification Number? Taxpayer Identification Number can be obtained by all the persons liable to pay taxes to the Ghanaian government. These include employees, employers, organizations, sole-proprietors et cetera.

Online Registration of TIN in Ghana

With technology so advanced, those who find the manual application process unwelcoming can decide to do the registration online.

First step

You will be required to create credentials. GRA has an online TIN registration in Ghana. The portal provides the access that you need. On the portal, you will be required to enter your name and give an email address. Next, you will be required to select the document you have scanned for identification. The materials may include:

- Driver’s License Number (DVLA)

- National Identity Authority (NIA) or Voter’s Card.

Once you have selected any of the options, the next step requires you to upload the scanned document for verification. The email and names will be validated after which a success message will be sent. The system will then generate an email with a link you will follow for you to continue with the registration

Second step

Follow the link provided in the email. On the URL, you will be required to enter the email and password you used for registration. Then click register to continue. This step will lead you to the TIN registration page. Fill the required tabs and save before you proceed.

The tabs constitute;

- Personal Summary

- Address and Contact details

- Tax Information

- Information for identification and

- Employment details

After filling all that is required under the tabs above and submitted, you will receive a confirmation message.

Third step

This is the last step of the online TIN registration in Ghana. It involves how to download registration certificate. In less than 14 days from application, the registration certificate will be sent to your email. You are then required to download, print and keep a copy.

How to get TIN Number in Ghana (Detailed Steps)

Here is how to get TIN Number in Ghana:

Part 1 (Create Temporary Credentials)

- Visit the Ghana Revenue Authority portal by clicking here.

- Fill in your basic details and choose a password

- Click the “add” button to attach your ID (It should be a good quality, colour scanned copy of the above identity card (pdf, gif, jpeg format)

- After adding, click on upload

- Click register on the same page.

- Wait while the Request is submitted

- Once the name, email and ID have been validated you will receive a Success Message. If you wish you may click on the button to view or print a copy of the submitted details

- Wait for system generated email; this will provide information on the registration process. The email will include a link to follow to continue your TIN Registration

- Follow the url contained in the email received

- Fill in the Email and Password (please note that these must be the ones that were registered earlier.

- Click Register to continue

- You will proceed to the TIN Registration Details Pages. Fill out the various Tabs, at the end of each Tab click on “Save and Proceed”. The tabs include:

- Individual Summary

- Personal Details

- Tax information

- Identification Information

- Address Details

- Employment Details

- Contact Details

- After providing all the above, click SUBMIT.

- You will receive a success message like in the photograph below. Sit tight and wait for your TIN. It should take a day or two but not more than 14 days.

Note: If you have used an NIA Card then TIN registration is automatic and you will receive an email notification within a minute or so. Other types of card require a GRA officer to vet your documentation before a TIN is issued. In all cases, your TIN Certificate must be picked up from your nearest GRA Office.

Requirements for Taxpayer Identification Number registration

Before you register as a taxpayer in Ghana, an individual must have any of the following documents

- A copy of a valid National Identity card

- A copy of a valid passport

- A copy of a valid driver’s license

- A copy of a legitimate voter’s identification card and

- Certificate or letters of business registration

14 things you cannot do without a TIN in Ghana

- Clear goods from the port

- Register your land document with the Lands Commission

- Obtain a tax clearance certificate from GRA

- Open a bank account

- Register your company at the Registrars General’s Department or any District Assembly office

- Receiving any payment from the Controller and Accountant General or a District Assembly in respect of a contract for the supply of any goods or provisions of any services

- Obtain payment for contracts done for the government

- File a case at the courts

- Obtain a passport from the passport office

- Obtain a drivers license and register your vehicle at the DVLA

- Bid for contracts from a government agency

- Conduct business with the Ministries, Departments and Agencies

- Cannot conduct business with the Metropolitan, Municipal and District Assemblies

- Register your Kids for Free SHS