How to get credit card in Ghana

A credit card is a plastic card issued by a bank that allows an individual to purchase goods and services up to a certain limit. It is a line of credit which the borrower draws on whenever required. The issuing bank of the credit card determines the limit a customer can borrow. However, before they issue the credit card, they assess the customer’s credit worthiness.

Getting a credit card in Ghana helps to curb the chances of loss of cash and encourages cashless financial transactions. The credit cards that are rampant in Ghana are Visa card, Mastercard and American Express. The use of credit cards in Ghana is still at an infant stage, especially when you compare it to advanced countries.

Benefit of credit cards in Ghana

- They can be used to purchase items online, and you don’t need to move along with lots of cash on you.

- It is helpful for those who want convenience when shopping, paying bills or making small transactions.

- It helps prevent scam as it helps you not to carry huge money on you for you to be a target for robbery.

- You can use it online wherever you are in the world.

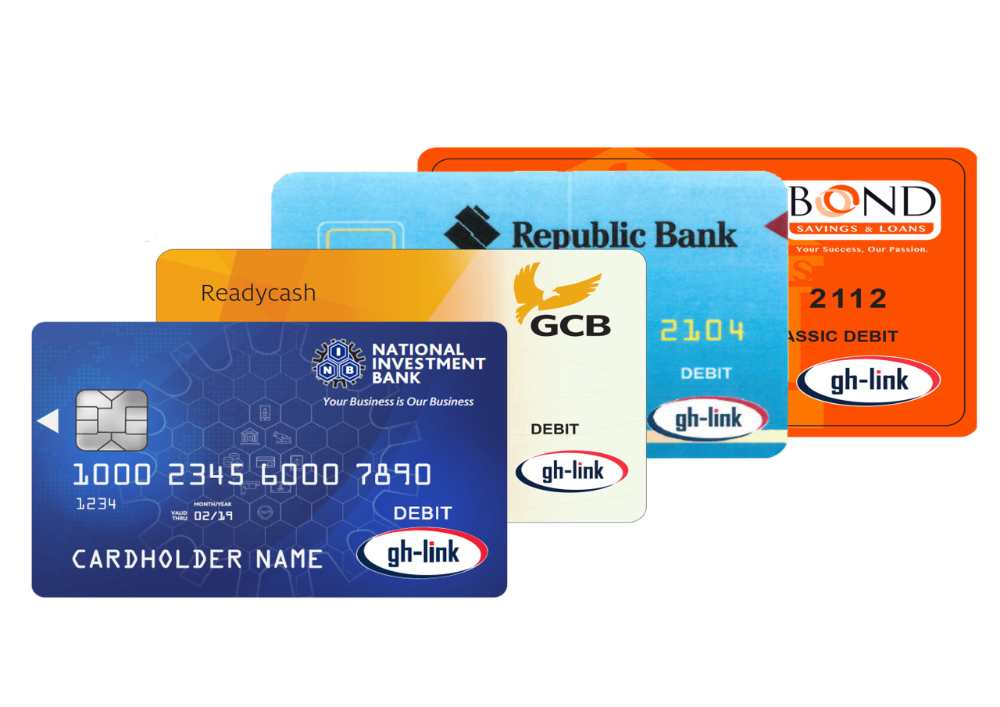

Banks in Ghana that gives credit card

- Guaranty Trust Bank

- EcoBank

- Bank of Africa

- ABSA Bank

- Access Bank

- Standard Chartered

- Zenith Bank

- Fidelity Fidelity

- Societe Generale Ghana

- First National Bank

- Cal Bank, etc

Getting a credit card in Ghana

Before you apply to any of the credit card in a Ghanaian bank issuing, ensure you have a relationship with them, basically, an active bank account. Ghana banks do not have a general database to measure the credit score of clients so they do rely a lot on the relationship customers have established with them.

This will provide them a fair idea of your cashflow and earnings. If you are self-employed, they may need some information about what you do and how you earn your income. If you are a salaried worker, the issuing bank may need your employer to sign an undertaking, promising to continually pay your salary via the bank.

How to get credit card in Ghana

- To get a credit card in Ghana, visit the preferred bank you want to host your account with and let them know your interest.

- From there, you will be asked some questions and possibly asked to create a bank account and if you qualify with all the necessary requirements, you will receive your card instantly or after some days depending on the bank.

Can i use a foreign credit card in Ghana?

No!. Credit card is largely accepted in Ghana establishment except at upscale restaurants and hotels. It would not be a best idea to plan to make a payment through this method. If you are capable to take cash advances on your Master Card, it would probably job in an ATM here for such objectives.

Conclusion

Credit cards can be used for many services where money is needed. It come in handy for international travelers since it gives them access to the currency where they may be visiting and protects their money from being stolen or lost while they are away from home. Wherever you find yourself in Ghana, having a credit card on you is a total flex.